Checking Out CVA Meaning in Business: What is a CVA Agreement?

Wiki Article

Ultimate Overview to Comprehending Company Voluntary Arrangements and How They Profit Businesses

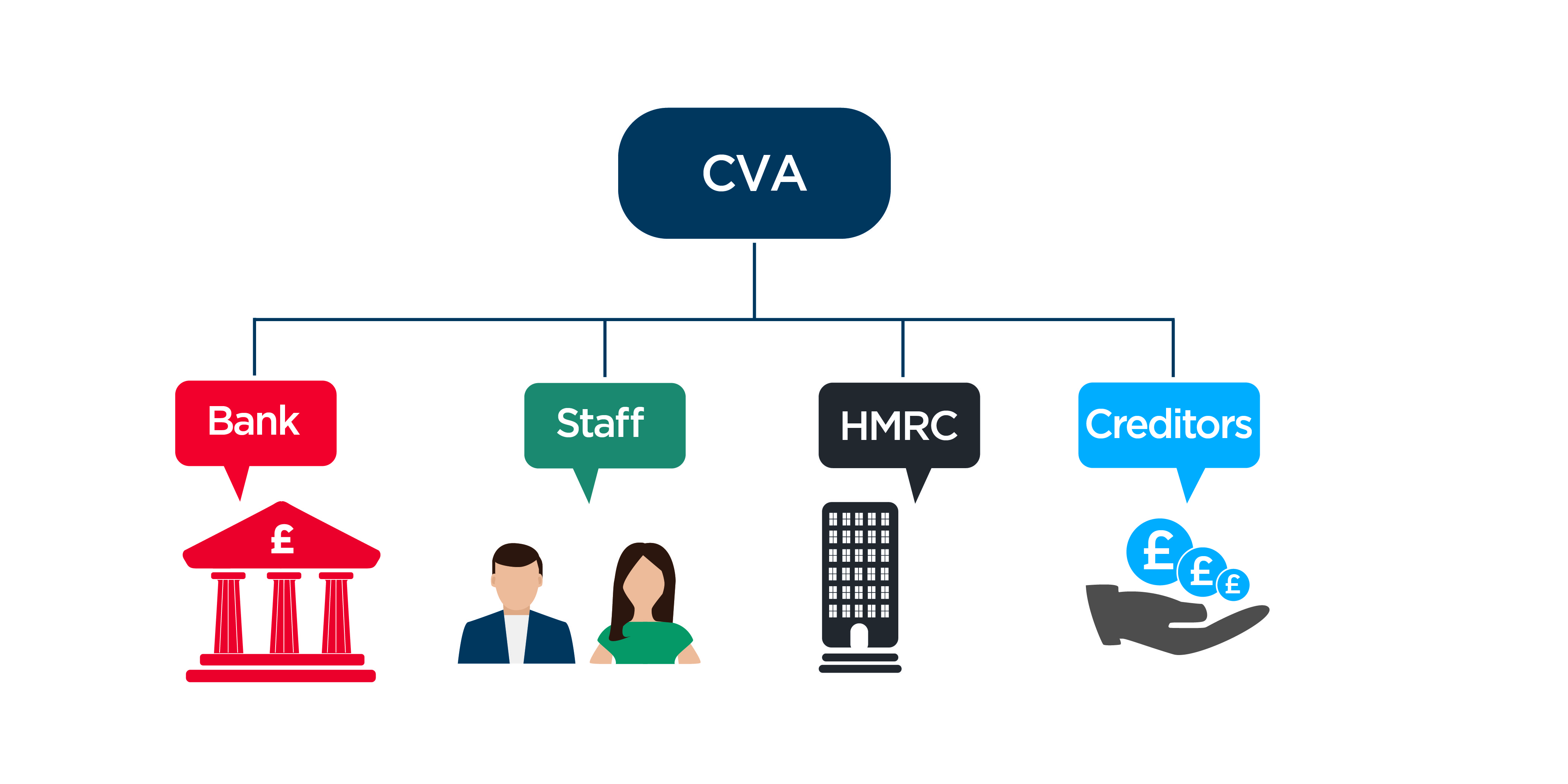

Business Volunteer Arrangements (CVAs) have ended up being a tactical device for services looking to browse financial difficulties and restructure their operations. As the company landscape proceeds to develop, understanding the complexities of CVAs and how they can positively influence business is vital for notified decision-making.Recognizing Corporate Volunteer Agreements

In the realm of corporate administration, an essential idea that plays a pivotal function fit the partnership between stakeholders and business is the elaborate mechanism of Business Volunteer Agreements. These agreements are volunteer commitments made by companies to abide by certain criteria, methods, or goals past what is lawfully needed. By becoming part of Company Volunteer Arrangements, business show their dedication to social responsibility, sustainability, and honest business techniques.One trick aspect of Corporate Volunteer Arrangements is that they are not legitimately binding, unlike regulative needs. However, companies that voluntarily devote to these contracts are still expected to support their guarantees, as falling short to do so can result in reputational damage and loss of stakeholder trust fund. These arrangements commonly cover locations such as environmental management, labor legal rights, variety and addition, and neighborhood involvement.

Benefits of Corporate Volunteer Contracts

Relocating from an exploration of Business Volunteer Arrangements' relevance, we currently transform our interest to the substantial benefits these contracts offer to business and their stakeholders (corporate voluntary agreement). One of the primary benefits of Business Voluntary Arrangements is the possibility for business to reorganize their financial obligations in an extra workable way.Additionally, Business Volunteer Arrangements can enhance the firm's online reputation and relationships with stakeholders by showing a dedication to dealing with monetary obstacles responsibly. In General, Corporate Voluntary Agreements offer as a critical device for business to navigate monetary hurdles while protecting their partnerships and procedures.

Process of Applying CVAs

Comprehending the process of applying Business Volunteer Agreements is necessary for companies looking for to navigate monetary obstacles effectively and sustainably. The first step in carrying out a CVA entails appointing a certified insolvency practitioner who will certainly work closely with the company to analyze its economic circumstance and viability. This initial analysis is crucial in figuring out whether a CVA is one of the most suitable solution for the firm's monetary difficulties. Once the choice to wage a CVA is made, a proposition detailing exactly how the firm means to settle its financial institutions is prepared. This proposal should be approved by the firm's lenders, who will certainly vote on its acceptance. If the proposition is approved, the CVA is carried out, and the business needs to stick to the agreed-upon settlement strategy. Throughout the application process, routine communication with financial institutions and diligent economic administration are crucial to the successful execution of the CVA and the business's ultimate monetary recuperation.Trick Factors To Consider for Businesses

One more important consideration is the level of openness and interaction throughout the CVA process. Open up and sincere communication with all stakeholders is vital for constructing count on and ensuring a smooth execution of the contract. Companies need to likewise consider looking for specialist recommendations from financial professionals or legal experts to browse the complexities of the CVA procedure efficiently.

In addition, companies require to evaluate the long-term effects of the CVA on their credibility and future funding opportunities. While a CVA can give immediate alleviation, it is important to examine how it may influence partnerships with financial institutions and financiers in the future. By meticulously thinking about these vital elements, organizations can make informed decisions relating to Corporate Voluntary Contracts and establish themselves up for a successful financial turn-around.

Success Stories of CVAs at work

Several businesses have actually efficiently applied Company Volunteer Contracts, showcasing the efficiency of this monetary restructuring tool in revitalizing their procedures. By getting in right into corporate voluntary agreement a CVA, Firm X was able to renegotiate lease arrangements with property managers, minimize overhead costs, and restructure its debt commitments.In an additional instance, Company Y, a production company burdened with legacy pension plan responsibilities, used a CVA to rearrange its pension obligations and simplify its procedures. Through the CVA procedure, Business Y accomplished significant price savings, boosted its competitiveness, and secured lasting sustainability.

These success tales highlight exactly how Company Voluntary Arrangements can offer battling companies with a sensible path in the direction of financial healing and functional turnaround. By proactively attending to financial difficulties and reorganizing obligations, business can arise stronger, extra nimble, and much better placed for future growth.

Final Thought

In final thought, Corporate Voluntary Agreements offer businesses a structured method to solving monetary problems and restructuring debts. By implementing CVAs, firms can stay clear of bankruptcy, safeguard their possessions, and maintain partnerships with financial institutions.In the world of business governance, a basic principle that plays an essential role in shaping the relationship in between stakeholders and business is the elaborate mechanism of Company Voluntary Agreements. what is a cva in business. By getting in into Corporate Volunteer Agreements, firms show their commitment to social duty, sustainability, and honest business techniques

Relocating from an expedition of Corporate Volunteer Agreements' value, we now transform our interest to the tangible benefits these agreements use to companies and their stakeholders.In Addition, Business Volunteer Contracts can boost the business's online reputation and connections with stakeholders by showing a commitment to attending to monetary obstacles responsibly.Recognizing the process of carrying out Corporate Voluntary Arrangements is vital for firms seeking to navigate economic challenges successfully and sustainably.

Report this wiki page